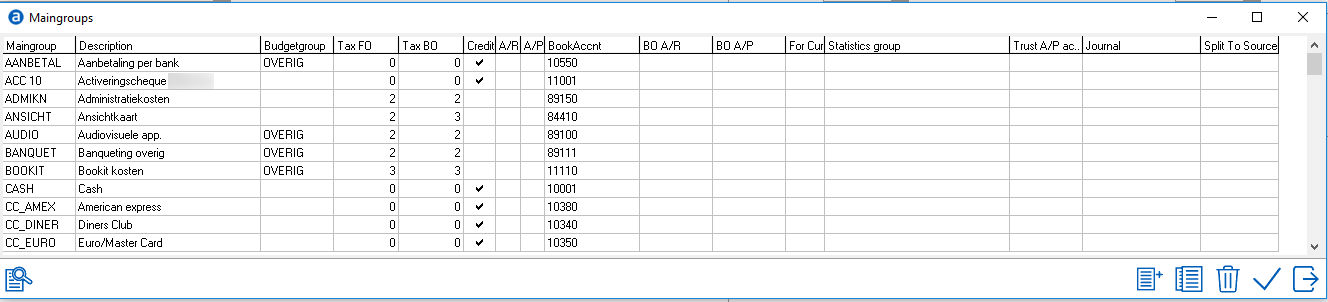

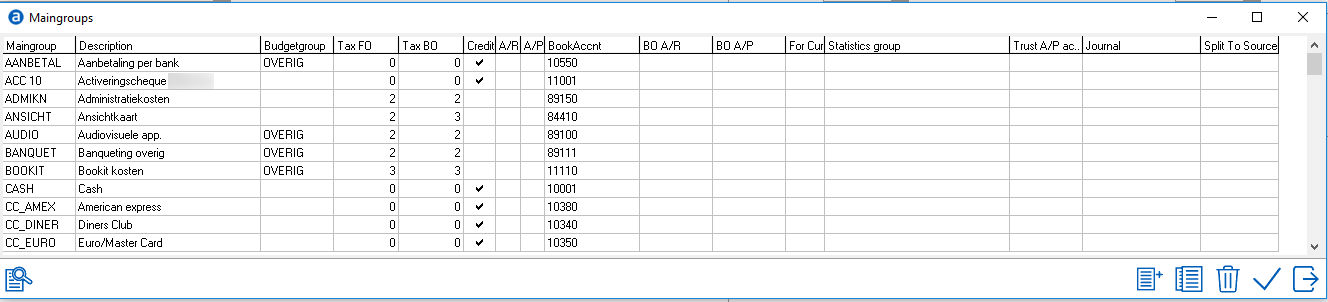

To add a new Maingroup, select the add/new icon;

Since revenue exporting to back office systems is done on maingroups, many options in the maingroup refer to the back office.

Since they are used differently depending on the kind of back office interface involved, not all comments may be relevant and should be verified with an Amadeus representative and the back office third party vendor.

Maingroup - Enter the code for the maingroup. (limited to 8 characters) alphanumerical. A code can only be entered when creating a new maingroup. The code cannot be changed once it is saved. It would need to be deleted and recreated if a typo occurred during initial setup.

Description - Enter the description for the maingroup (max. 30 characters)

Budget group - Select the budgetgroup for this maingroup. For info on budget groups see Financial hierarchy

Tax Front Office - This is only used when VAT taxes are used. This tax setting will calculate the tax for invoice purposes. The value entered here will use the tax % from option, Financial (1) Option Financial (1) It is not used when additional taxes are in use. Most hotels in the U.S. will not use this field. See notes below for VAT settings.

Tax Back Office - This is only used when VAT taxes are used. This tax will calculate the tax for reporting purposes on reports (Revenue Report)

Why Two tax settings?

In some cases (POS Interface postings for example) the revenue (and associated tax) is send to accounting directly from the POS system.

Then the interfaced bookings should have a 0% tax, as otherwise taxes are counted twice.

However on the invoice the tax must appear correctly, so TAX Front office should have the correct tax setting.

Credit - please indicate here if this maingroup is a credit maingroup (payments) or not. If it is, activate this option.

Is A/R maingroup - If this maingroup is used for Accounts Receivable payments, please activate this option.

Is A/P maingroup -

Book account - This is the number for the back office interface. This number usually equates to the General Ledger Account number in the back office. To map maingroups to a back office interface, this book account should be filled.

Back Office A/R number - This is for back office purposes only. B/O systems may want to map to a B/O Accounts Receivable number.

Back Office A/P number - This is for back office purposes only. B/O systems may want to map to a B/O Accounts Payable number.

Profit center - This is for back office purposes only. Some B/O systems have profit centers and this will map to the assigned profit center in the B/O system.

Division - This is for back office purposes only. Some B/O systems have revenue divisions and this will map to the assigned division center in the B/O system.

Foreign currency - If this maingroup is a foreign currency (like CAD or Euro or USD) , this option should be activated. See also Exchange Rate

Book in detail - This is for back office purposes only. Charges will book in detail to B/O interface if supported.