The Accounts Payable Module in IDPMS is optional and a valid license is required to activate the module. Accounts payable in IDPMS is used in conjunction with Trust Accounting and Travel Agent Commissions. An AP number is automatically assigned to the relation profile. This happens to relations that are Travel Agents and the commission module is activated. See Processing Agent Commissions for more information. After a folio is checked out where the folio was linked to a travel agent profile that is commissionable, the AP number will be assigned to that Agent profile.

For relations (Guests) that are part of the Owner Trust Accounting Module, an AP number is manually assigned using the add/new icon in Accounts Payable Account. See Owner Trust Accounting for more details.

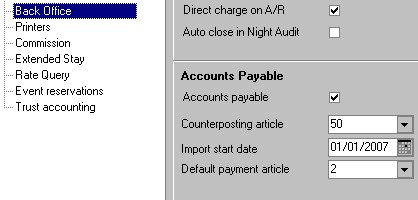

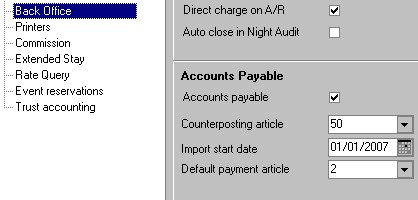

To activate the module, go to settings->Options->Back Office

Once a license has been activated, check the Accounts Payable box.

Counterposting Article: Link the Accounts Payable counterposting Article.

Import Start Date: Enter the Cutover date for the property or the date when all Accounts Payable transactions should be transferred to AP.

Default Payment Article: Link the Default Payment Article (usually the check/cheque payment article

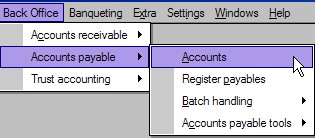

To Access Accounts Payable, go to menu Back Office->Accounts Payable-> Accounts

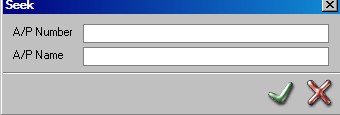

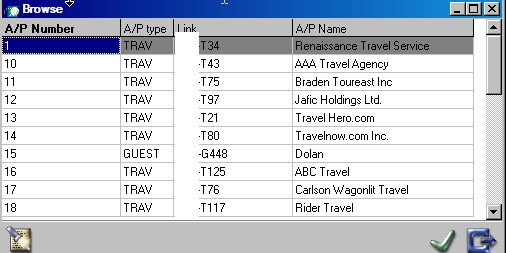

This will launch the Account Seek Window.

Enter the A/P Number or A/P Name.

If nothing is entered and the green checkmark is selected, a browse window with ALL A/P accounts will appear. Select the account required by clicking on the line (highlighting it)

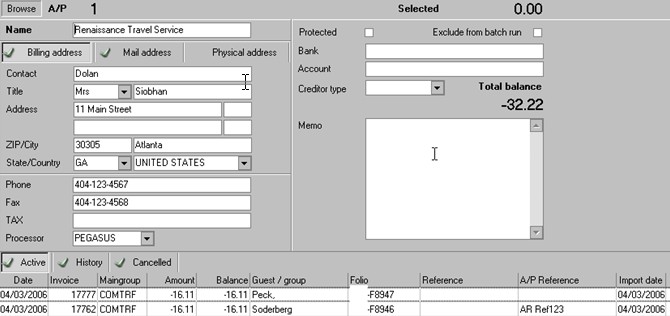

Screenshot of AP Account # 1

Explanation of all AP Fields

This is the name of the AP Account.

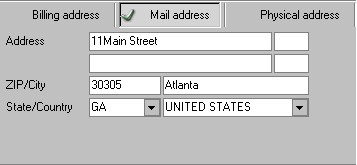

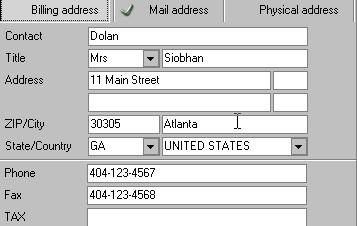

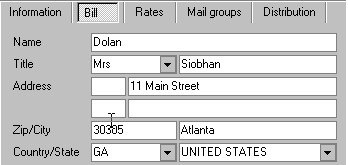

Each A/P Account can have 3 different addresses. To Change an address, click on the appropriate tab (Billing, Mail or Physical). A change in address will also be reflected in the Relation profile (Agent, Company or Guest)

A Billing address can have a contact linked. This is also linked to the Relation Profile under the Bill tab.<>

< >Bill>

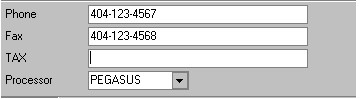

Phone-> Fax ->Tax (Company Tax ID if applicable)

Processor - > Enter the commission processor (could be Check, Pegasus, Perot or other third party commission processor) The Commission processor identifies how commissions are paid. If a property is processing travel agent commission through IDPMS, this field must be filled for all commissionable agents. This field is also used for processing Trust Owner Accounts. See Owner Trust Accounting

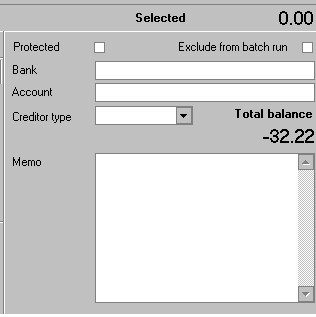

Selected –> This field will show the balance of the selected invoices in the Active Tab (which is described later)

Exclude from Batch Run - By checking this box, the A/P account will be excluded from a batch run of statements used in the Trust Accounting module.

Protected - > If this is checked, it will protect changes/modifications to the account for users who do not have access rights to change a protected account.

Bank-> Enter Bank Name if applicable for the account.

Account-> Enter the Bank Account Number if known or applicable.

Creditor Type-> Creditor Types can be created for each property and it allows the property to identify or group their AP Accounts by Creditor Type(s)

To create Creditor Types -> Settings-> Financial-> Creditor Types AP Types

Total Balance -> This displays the total balance of all combined active invoices on the account.

Memo-> This is an unlimited text field.