Processing Travel Agent commissions can be handled in IDPMS. IDPMS uses the Accounts Payable Module for this function. A valid AP license is required and Accounts Payable Module needs to be activated.

Go to Settings-> Financial- >Maingroup. A total of five Maingroups need to be setup for commission processing.

1. COM-Commission

Link appropriate Budget Group and Book Account number.

2. COMBP- Commission Batch Payment

Check credit option

Link appropriate Budget Group and Book Account number

3. COMCP- Commission Counterposting

4. COMPP – Commission Prepaid (used if Agents send in room prepayment less their commission % amount)

5. COMTRF – Commission Transfer

Check Credit option

Check Is A/P Maingroup

6. COMGST – This is used for Hotels inCanada that pay GST on commissions

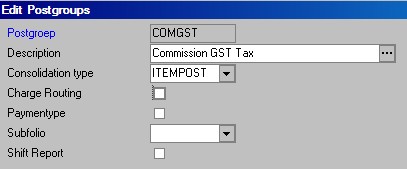

Under Settings-> Financial-> Postgroup-> set up the five Postgroups for Commission handling as follows;

Check Payment Type

Check Payment Type

6. COMGST - Commission GST - Needed for Hotels that pay GST on commission.

Under, Settings-> Financial,->Articles, set up the Commission handling articles as follows and link them to the corresponding Main and Post Groups;

Article sample 899 below is only required for hotels that have commission plans where GST tax is calculated. This article will then need to be used in the commission plans that calculate GST % and have a separate chargeplan.

Go to settings-> Financial-> Commission Plan.

Create a new plan

Create the breakdown for the Plan

Maingroup: Link to the Room Revenue Maingroup (were the % commission calculation occurs)

Note- If the hotel, has multiple Maingroups for room revenue distribution, a separate line in the commission breakdown for each and every one of the room revenue maingroups will need to be created.

Percentage/Amount: Enter the commission type (percentage or flat amount)

Percentage: Enter the %

Amount: Enter the flat $ amount

Article: Link to the commission Article PLU # (see Financial settings section)

Description: Description of the commission plan (limited to 30 characters)

Excluding VAT: Check if VAT should be excludes in the room commission calculation.(only used in Europe)

Note: Fields in Blue are mandatory.

Sample of a Commission Plan where there are multiple Maingroups for room revenue is outlined below. The example includes a 10% commission plan where commission is calculated as 10% of the room revenue. This plan is also linked to article 899 which has a special charge plan that handles GST tax in addition to the commission.

In Canada, many Canadian Travel Agents get paid GST on the commission amounts. In order to set this up, a special article and charge plan need to be created.

The Article is linked to the Commission Main and Post Groups. It is also linked to a charge plan ‘COMGST’

It is important to link the GST tax to a separate POSTGROUP in the charge plan as shown below.

In settings-> Financial-> Batch Commission Payment, add the type of commission payment required. Hotels who will pay commissions in a check batch should set up CHECK as the batch payment. Hotels using third party commission payables can set up the batch payment for PEGAGUS or PEROT Systems. (see samples below)

Note: Hotels can only use one Batch Payment Type and NOT a combination of more than one.

The Agent Relations that are commissionable need to be set up as follows;

1. Assign a default comm.. Plan. By selecting a default commission plan and linking it to the Agent Profile, each time a reservation is linked to that Agent, the default plan will be assigned to the folio.

2. Batch comm.: A type of Batch commission payment needs to be assigned.

3. IATA Number: Enter the Agent IATA number.

Registering Accounts Payable

All invoices that have been checked-out that are commissionable will remain in a suspense account until they are registered to Accounts Payable.

To register, go to Back Office, Accounts Payable,

Enter the date span to register invoices.

Select the Green Check mark to register.

Commission batches can be created once the folios have been checked out and settled to accounts payable. Commission is posted on Sub folio E once an Agent and Commission Plan are linked to a folio. Once room revenue is posted, commission will also be posted for the applicable folios.

Sample of a checked out folio with Commission posting.

From the Back Office Menu, select Accounts Payable, Commission Handling, Prepare Commission Batch.

Select the Cutoff date

Select the Payment Type

Select and highlight all lines to include in the batch (use Shift key)

Select Green Check Mark.

Select ‘Yes’

Commission Batch is created and assigned a Number.

To Review a Commission batch, go to Back Office, Accounts, Payable, Commission handling, Batch details.

Select Payment Type.

Select Green Check Mark.

All unprocessed batches are listed.

Select the Batch for review and select the breakdown icon.

Go to Back Office, Accounts Payable, Commission Handling, Process Batches.

Select Payment Type.

Select green Check Mark

Select ‘Yes’

This will then Transfer the Commissions to IDCRS. The Commissions will then be handled at Central Reservations.

In IDCRS, go to Extra->Commission Handling->Pending Commissions.

This will show all pending commissions.

A special commission transfer tool (.exe) will be used to process and send the commission batches to Pegasus or other third party commission processor.

Launch the Comtransfer.exe

Login with username and password (same as used in IDPMS)

Select Green checkmark to process commissions.