Different rules pertain to Trust Owner Accounting based on location. Rules can vary per property, per State/Province and Country. Some management companies may account for room assets and calculate depreciation on these assets over time.

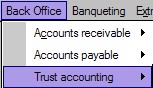

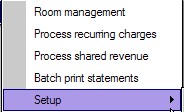

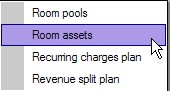

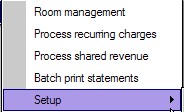

The setup of Room Assets can be done as follows:

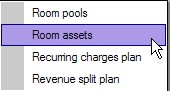

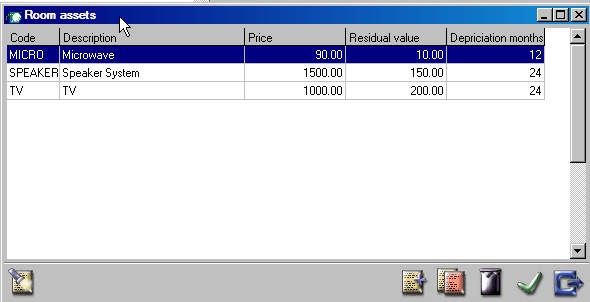

Once selected, the Room assets window opens

Select the add icon to add a new asset to the list. The list of assets is setup per property and includes all assets of the property. The applicable assets can then be linked to the appropriate rooms or units.

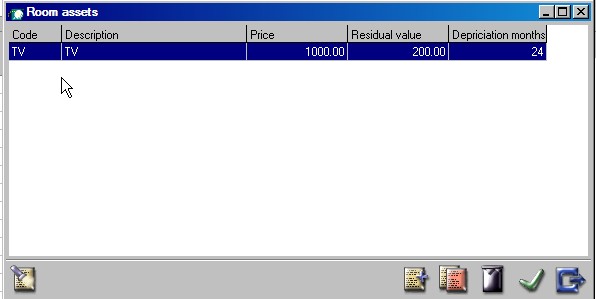

Select the add icon to add a new asset to the list. The list of assets is setup per property and includes all assets of the property. The applicable assets can then be linked to the appropriate rooms or units.

Code - is a mandatory field and is limited to 8 characters.

Description - enter a description of the asset.

Price- enter the purchase price of the asset.

Residual value - enter the value of the asset after the number of depreciation months.

Depreciation months - Enter the number of months for depreciation.

Save using the green checkmark.

All assets for the property are listed.

Close the window.

Close the window.

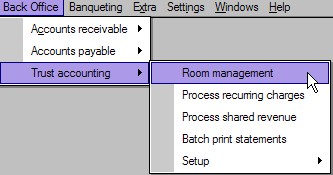

Linking Assets to Rooms

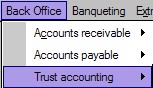

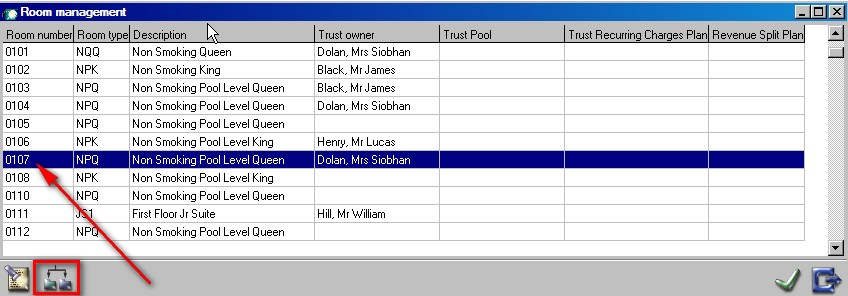

Assets are linked through 'Room Management' See Room Management for more details.

Highlight the room number and select the breakdown icon

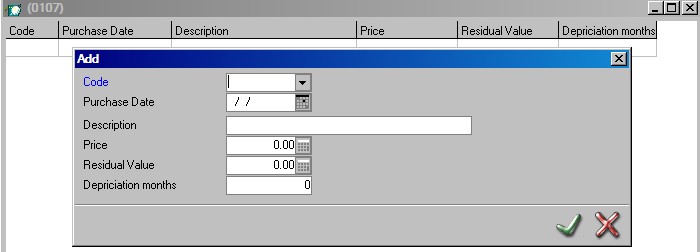

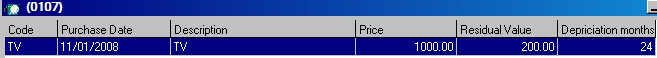

In the example below an asset of TV is linked to room 0107.

Code - Select asset from the list. (picklist of room assets)

Purchase date - Enter the purchase date of the asset (used to calculate depreciation)

Price - Enter the purchased price of asset

Residual Value - Enter the residual value of the asset after 'X' months of depreciation as outlined in depreciation months.

Depreciation months - Enter number of months for depreciation residual value.

Currently IDPMS only shows depreciation for reporting purposes and does not include any calculations in the Trust Module. It is the owners responsibility to claim depreciation back on their taxes.