When a fiscal VAT% is changed the VAT configuration in IDPMS has to be changed as well. This topic describes how to change or add VAT codes in IDPMS.

In this Topic Hide

1. Pre-configuring the VAT percentage

2. Changing VAT configuration in maingroups on 1-7-2020

3. Adding a new VAT group to the configuration and change maingroup configuration on 1-7-2020

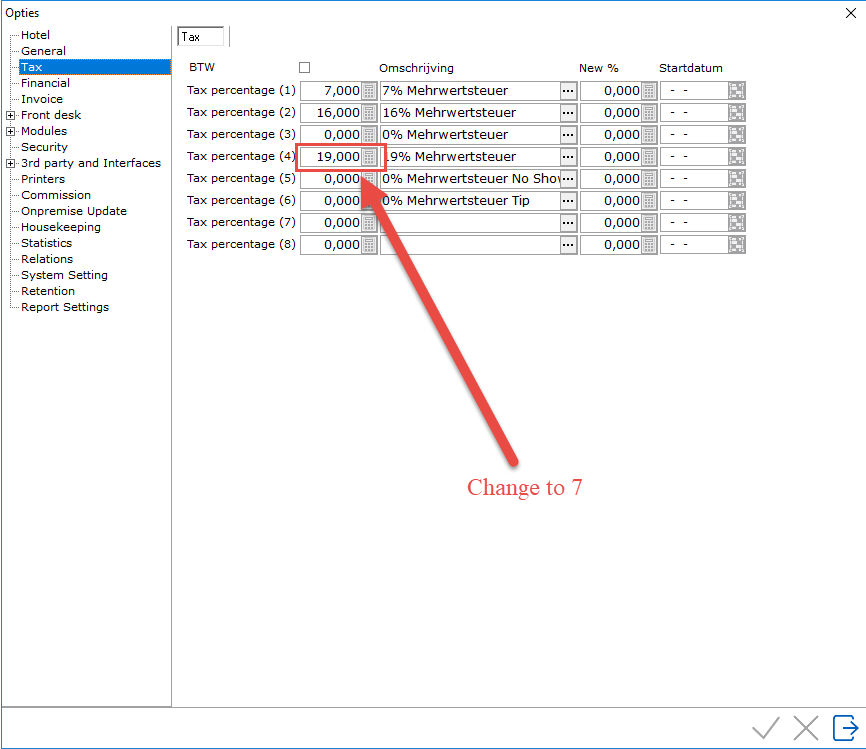

In IDPMS go to Settings > Options > Tax to view the current VAT code setup. Note: until IDPMS version 4.1.3 this option was called Financial (1).

IDPMS contains 8 VAT groups, no additional groups can be created.

There are multiple methods to change VAT, which one will be best suited for your situation depends on the current configuration. 4 methods are described in this topic.

In the example used in this topic, F&B tax changed from 19% to 7% on July 1st 2020.

In IDPMS version 4.1.5 and later it is possible to setup new VAT percentages in advance in case of a future VAT change. To do this, Go to Settings > Options > Tax.

In the column "New %" the new VAT percentage needs to be filled for those VAT groups that will need to be changed. The start date can be filled with the intended start date for the new VAT percentages. For example:

When these values are filled, pro forma invoices and forecast data will make use of the new percentages for calculations falling after the start date that was entered in the start date column.

During the night audit where the IDPMS system date reaches the filled out start date, the values from the “New %” column will be moved to the column containing the original percentages and the values in the “New %” and Start Date columns will be deleted.

See Option Tax for more information.

!!After applying the changes IDPMS must be restarted on all workstations!!

Caveats and restrictions: This method will only produce the desired result if the VAT group that is changed is not used for any maingroups that should not be affected by this change. Please check the VAT front and VAT back configuration in the maingroups (Settings > Financial - Maingroup) before using this method. See Maingroups for more information.

When the setup contains only the different VAT groups without any further differentiation (like the picture underneath), this will be the best method to make the change from 19% VAT to 7% VAT.

This method will involve changing the VAT front and VAT back values in maingroups that are affected by the VAT percentage change. In order to do this, please go to Settings > Financial > Maingroup and change the VAT back and VAT front values from 19% (4 in the example above) to 7% (1 in the example above).

This change will need to be done on 1-7-2020 after the audit.

!!After applying the changes IDPMS must be restarted on all workstations!!

Caveats and restrictions: The VAT change cannot be configured beforehand and therefor pro-forma invoices and forecast reports will use the currently configured VAT percentage.

In case there is an available, non-used, VAT group left in the configuration, this can be used to create a new VAT group for 7% VAT. Please note that the new VAT group has not been configured in the screenshot below.

This method will involve changing the VAT front and VAT back values in maingroups that are affected by the VAT percentage change. In order to do this, please go to Settings > Financial > Maingroup and change the VAT back and VAT front values from 19% (4 in the example above) to the newly configured VAT group (8 in the example above).

This change will need to be done on 1-7-2020 after the audit. If this is not possible, the changes must be made before any financial posting is done in IDPMS. These changes cannot be made earlier. It is not possible to recalculate any postings made with the old VAT% afterwards.

!!After applying the changes IDPMS must be restarted on all workstations!!

Caveats and restrictions: The VAT change cannot be configured beforehand and therefor pro-forma invoices and forecast reports will use the currently configured VAT percentage.

This method is similar to the method described in point 1, but it cannot be configured in advance. On 1-7-2020 the 19% for the affected VAT group can be changed into 7%, this must be done on 1-7-2020 after the audit. If this is not possible, the changes must be made before any financial posting is done in IDPMS. These changes cannot be made earlier. It is not possible to recalculate any postings made with the old VAT% afterwards.

!!After applying the changes IDPMS must be restarted on all workstations!!

Caveats and restrictions:

The VAT change cannot be configured beforehand and therefor pro-forma invoices and forecast reports will use the currently configured VAT percentage

This method cannot be used if this change will also affect maingroups that need to retain the 19% VAT percentage

All workstations/users must exit IDPMS and only may re-enter IDPMS when all changes have been made and verified.

If you use a back office interface for exports to your back office software you must first export the period prior to making the VAT changes!! This only applies for the days that not have been exported previously. If you use a back office interface the configuration of this interface might also need changes to the VAT code configuration. Contact the Amadeus Hospitality Support Team to change the configuration of your back office interface. If a configuration change in the back office interface is required these also must be made before creating new export files.

When not adding a new a VAT code and only changing the current codes / VAT% the invoices containing posting entries made with both the old VAT% and the new VAT% will show on the invoice with the new VAT% and description only. This will most likely be case for guests that have stayed at the hotel during the VAT% changes were made. The calculated VAT amount may be a combination of the old and new VAT%.

Example:

Guest stays 2 nights. 1 night prior to the VAT% change and 1 night after the VAT% change.

The first night the old VAT% will be used on applicable postings, the second night the new VAT% will be used on applicable postings.

1 Beverage at 21% à €3,00 will have 21% VAT calculated the first night à €0,52.

1 Beverage at 25% à €3,00 will have 25% VAT calculated the second night à €0,60.

The invoice will sum these 2 amounts to €1,12. with VAT 25% / New description as description.

Under the old VAT% the total VAT for examples above would have been €1,04. With the new VAT% the Vat would have been €1,20. Invoice will show in this case €1,12. A Difference €0,08