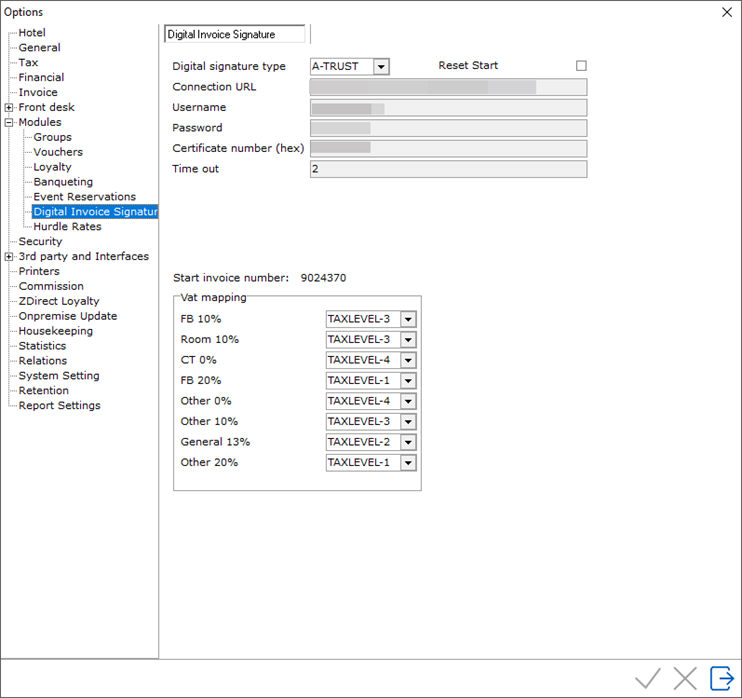

To access Module Digital Invoice Signature, go to Settings > Option > Modules > Digital Invoice Signature

If a Digital invoice Signature module is required, the settings need to be activated here.

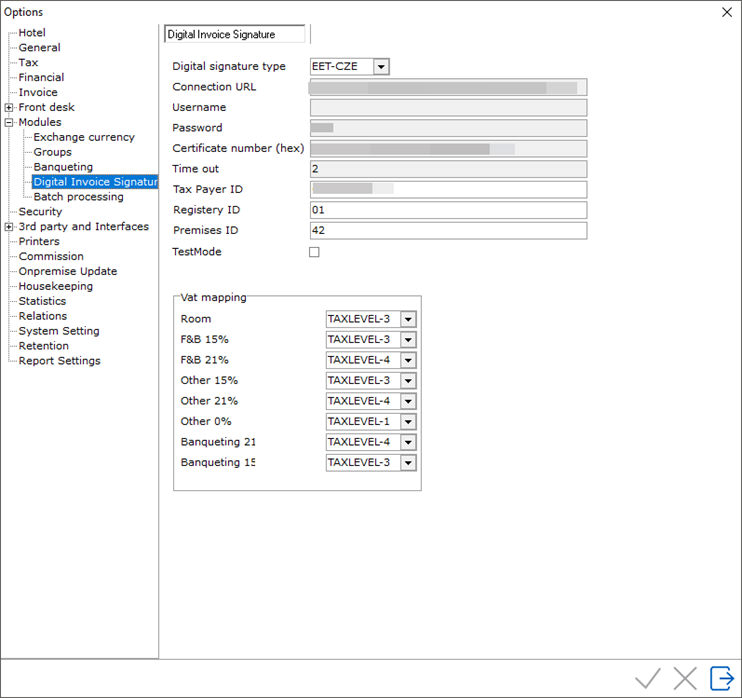

To access Module Digital Invoice Signature, go to Settings > Option > Modules > Digital Invoice Signature

Digital signature type - Select A-TRUST for hotels in Austria. Select EET-CZE for hotels in the Czech Republic.

A-TRUST:

Reset Start - This tick box is ticked after installation and creates a start invoice. After installation, it is only to be used if requested by the BMF (Austrian Finance Ministry)

Connection URL – The web address where IDPMS needs to send the data to. This is provided by A-TRUST and set at installation.

Username – Username provided by A-TRUST

Password – Password provided by A-TRUST

Certificate number (hex) – Certificate number, provided by A-TRUST

Time out – Default is 2 minutes

VAT mapping

IDPMS sends the VAT used in the invoice to A-TRUST. A-TRUST supports 4 levels.

TAXLEVEL-1 Standard tax level

TAXLEVEL-2 First reduced tax level

TAXLEVEL-3 Second reduced tax level

TAXLEVEL-4 Not taxable

EET-CZE

Connection URL – The web address where IDPMS needs to send the data to. This is provided by EET and set at installation.

Username – Username provided by EET

Password – Password provided by EET

Certificate number (hex) – Certificate number, provided by EET

Time out – Default is 2 minutes

Tax Payer ID – TAX number of the property, provided by EET.

Registry ID – Unique ID for EET to recognize IDPMS as register

Premises ID – Unique ID for EET to match with the Tax Payer ID.

Test Mode – tickbox to transmit invoices data as test

VAT mapping

IDPMS sends the VAT used in the invoice to EET. EET supports 4 levels.

TAXLEVEL-1 Standard tax level

TAXLEVEL-2 First reduced tax level

TAXLEVEL-3 Second reduced tax level

TAXLEVEL-4 Not taxable