In this Topic Hide

From 1 January 2020, a so-called "combined measure" applies to the tourist tax. This means that, in addition to a percentage of the revenue, you also have to pay a fixed amount per person per night, the so-called "fixed rate". This only applies to commercial rental from non-residential properties such as hotels and campsites.

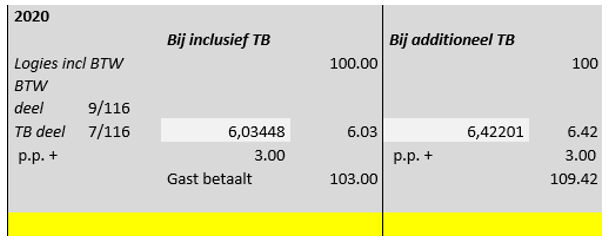

The tourist tax for commercial leasing from non-homes in 2020:

More information can be found here.

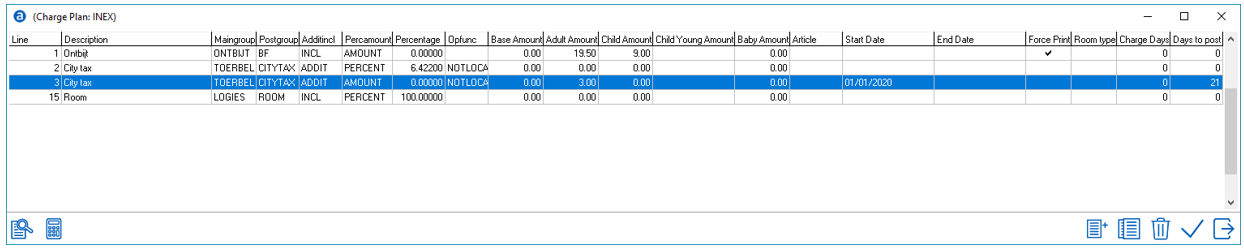

Starting on the 1st of January 2020 all chargeplans where tourist tax is automatically posted need to be adapted to reflect the changes. If you’re running IDPMS version 4.1.5 or later, this can be done beforehand using the start- and end date fields in the chargeplan configuration.

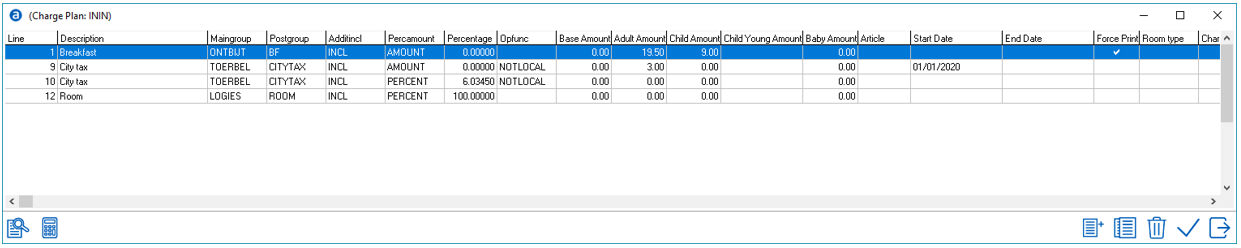

It is necessary to check all chargeplans if they contain a line regarding tourist tax calculation. How to calculate the correct percentages can be found further down this document.

Concerning the fact that LTT only needs to be calculated over the nett room revenue (excluding breakfast, F&B, etc), all amounts in IDPMS are gross amounts and LTT should not be calculated over VAT there might be several possible scenarios.

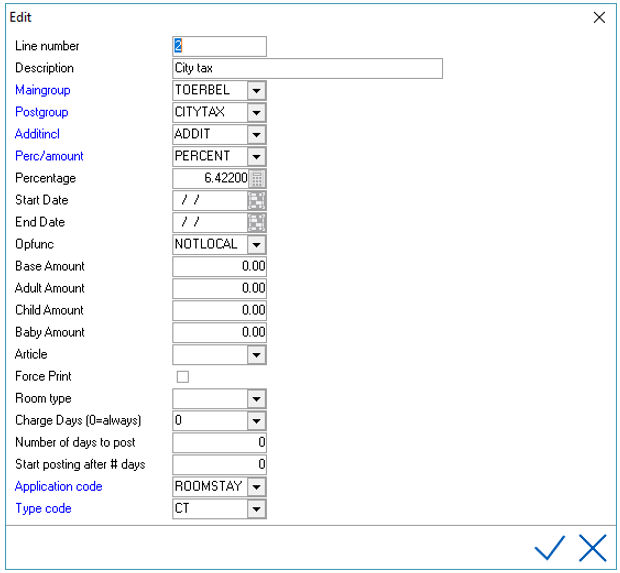

In the chargeplan the lines for tourist tax are set to ADDIT. The percentage of 7% is not entered as such because that would cause a calculation of LTT over VAT. Please keep in mind that the chargeplan will be calculated in order of line numbering. This means that the calculation of tourist tax using a percentage must always take place after the breakfast (if included) has already been processed in the chargeplan (so the tourist tax always has a higher line number).

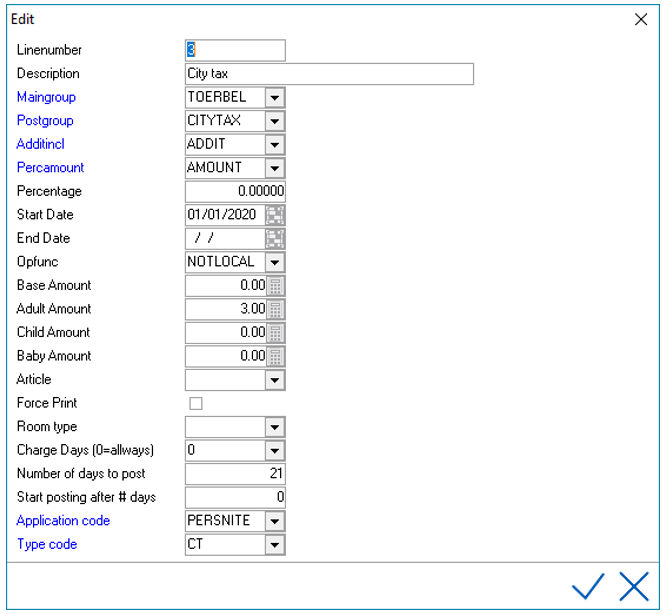

A separate line can be added for the fixed charge of €3,- per person per night. Keep in mind that this is for a maximum of 21 nights, meaning we will use the “number of days to post” field in the configuration as well. Users of version 4.1.5 and higher could set a start date of 1-1-2020.

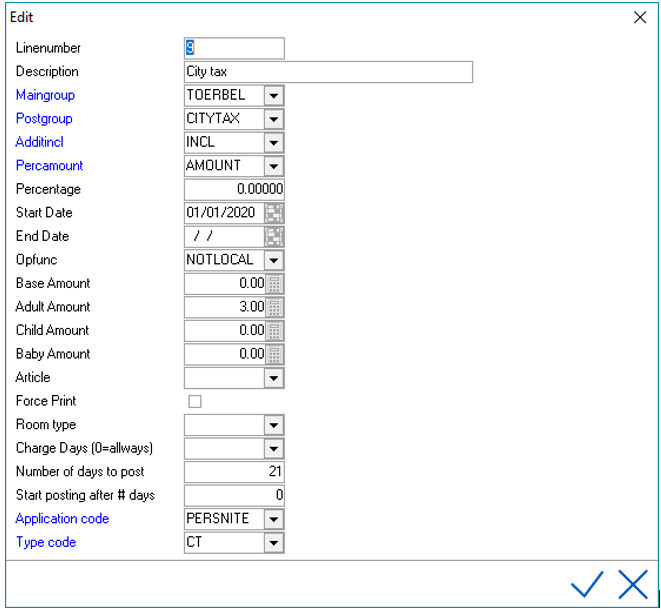

A line can be added for the fixed charge of €3,- per person per night. Keep in mind that this is for a maximum of 21 nights, meaning we will use the “number of days to post” field in the configuration as well. Users of version 4.1.5 and higher could set a start date of 1-1-2020.

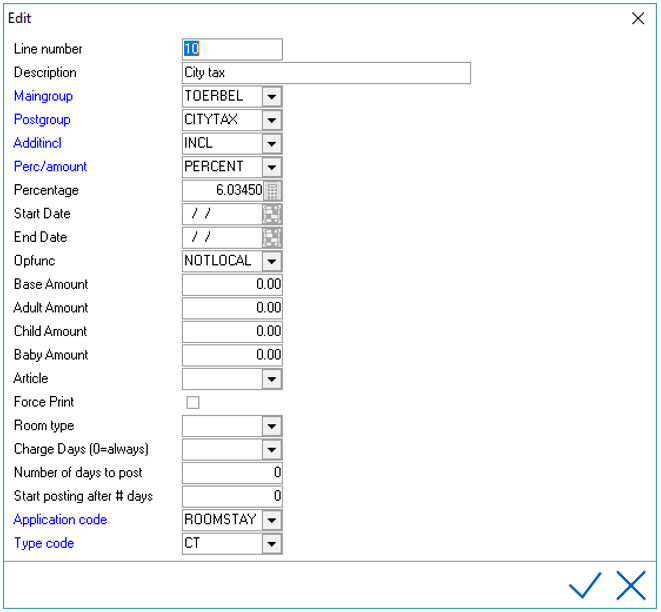

In the chargeplan the LTT lines are set to INCL. The percentage of 7% is not entered as such, because it would mean that LTT would be calculated over VAT. This amount MUST be placed before the line of 100% roomnight. The percentage needs to be set to 6.03450.

In case of specific chargeplans that work differently (e.g. Expedia, which explicitly calculates 6% VAT and 7% LTT afterwards), the percentage line needs to be 7% and a separate line should be added for the €3,- p.p.p.n. fixed rate.

Calculation example

When these changes have been made, the financial postings during the night audit will be executed using the new values. The total reservation value in IDPMS for existing reservation as showing in the reservations will not show a change however, unless these reservations are changed and stored again.

Confirmations will normally contain a sentence about LTT. As there is a change in LTT, this should also be amended in the confirmations. An instruction on how this can be done is being developed.

Please note that in case Amadeus Hospitality is requested to make these changes, this will be a billable request as confirmation changes are not part of the support agreeme